The Facts About Ia Wealth Management Revealed

The Facts About Ia Wealth Management Revealed

Blog Article

The 10-Second Trick For Retirement Planning copyright

Table of ContentsThings about Tax Planning copyrightThe 7-Minute Rule for Tax Planning copyrightA Biased View of Ia Wealth ManagementFinancial Advisor Victoria Bc - The FactsAll about Independent Financial Advisor copyrightThe 6-Minute Rule for Retirement Planning copyright

“If you had been to buy something, state a television or a personal computer, you'll need to know the specs of itwhat are their elements and just what it can do,” Purda explains. “You can remember purchasing economic guidance and support in the same manner. Folks must know what they're purchasing.” With monetary advice, it is important to understand that the product isn’t bonds, shares and other financial investments.it is such things as cost management, planning pension or paying down financial obligation. And like getting a personal computer from a dependable organization, customers need to know they truly are purchasing economic information from a dependable expert. Certainly one of Purda and Ashworth’s best findings is about the charges that financial coordinators charge their clients.

This conducted genuine regardless the cost structurehourly, commission, assets under management or flat fee (from inside the learn, the buck property value charges ended up being the same in each case). “It however comes down to the worth proposal and uncertainty on buyers’ part they don’t understand what they are getting in change for these fees,” states Purda.

Some Known Details About Investment Consultant

Hear this particular article whenever you notice the definition of financial advisor, exactly what pops into the mind? Lots of people consider an expert who is going to give them financial guidance, especially when you are considering spending. That’s a great place to start, although it doesn’t color the total picture. Not close! Monetary advisors enables people with a lot of additional money objectives too.

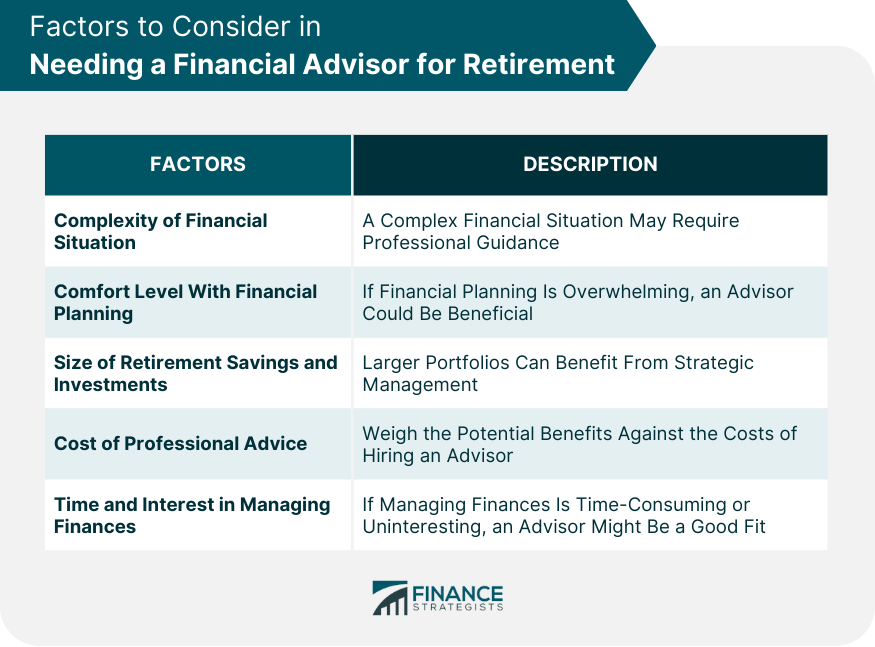

A financial expert assists you to create wide range and shield it for the long haul. They're able to calculate your personal future financial needs and strategy methods to extend the your retirement cost savings. They are able to also advise you on when to start making use of Social Security and using the funds inside your retirement records to stay away from any unpleasant penalties.

The 2-Minute Rule for Investment Consultant

Capable support find out exactly what common resources tend to be best for your needs and explain to you tips handle and make probably the most of your financial investments. They're able to in addition let you see the risks and what you’ll ought to do to attain your goals. A seasoned investment expert will also help you stick to the roller coaster of investingeven when your financial investments just take a dive.

They could provide guidance you will need to create plans so you're able to make fully sure your wishes are performed. And you can’t place an amount label on the reassurance that accompanies that. In accordance with research conducted recently, the typical 65-year-old pair in 2022 needs to have about $315,000 saved to cover healthcare expenses in your retirement.

Not known Factual Statements About Retirement Planning copyright

Since we’ve reviewed what economic experts carry out, let’s dig into the various types. Here’s a beneficial rule of thumb: All economic planners are economic experts, yet not all experts navigate to this site tend to be coordinators - https://www.pearltrees.com/lighthousewm#item571856692. An economic planner is targeted on assisting men and women produce intentions to attain long-lasting goalsthings like starting a college account or keeping for a down cost on a house

How do you know which financial specialist suits you - https://fliphtml5.com/dashboard/public-profile/cibon? Here are some actions you can take to make sure you’re employing best person. Where do you turn if you have two poor options to pick from? Easy! Find more choices. The greater number of solutions you've got, the more likely you're to manufacture an effective choice

About Investment Representative

Our very own wise, Vestor program makes it possible for you by showing you around five economic analysts who is able to last. The good thing is actually, it’s completely free attain regarding an advisor! And don’t forget about to come calmly to the interview prepared with a list of concerns to inquire about so you're able to determine if they’re a great fit.

But tune in, just because an expert is smarter as compared to average bear doesn’t let them have the ability to tell you how to proceed. Often, analysts are full of by themselves since they have more degrees than a thermometer. If an advisor starts talking down for your requirements, it’s for you personally to suggest to them the entranceway.

Just remember that ,! It’s essential along with your financial advisor (the person who it ultimately ends up getting) take the same web page. You prefer an expert who has got a long-lasting investing strategysomeone who’ll motivate one keep investing regularly whether the marketplace is upwards or down. investment representative. Additionally you don’t wish utilize a person that forces one purchase something’s also dangerous or you are not comfortable with

Rumored Buzz on Retirement Planning copyright

That mix offers the variation you should successfully invest when it comes to long haul. Whilst research financial advisors, you’ll most likely come across the definition of fiduciary obligation. This all implies is any advisor you employ must work in a fashion that benefits their own customer rather than unique self-interest.

Report this page